Payday - ATO Tax Calculator

Simplify your tax calculations by using our powerful ATO tax calculator.

Payday Australia uses official ATO tax brackets for weekly, fortnightly and monthly withholding tables, formulas and common rules for HELP/HECS, SFSS just to mention a few.

** Updated with 2018/19 Tax scales **

Features:

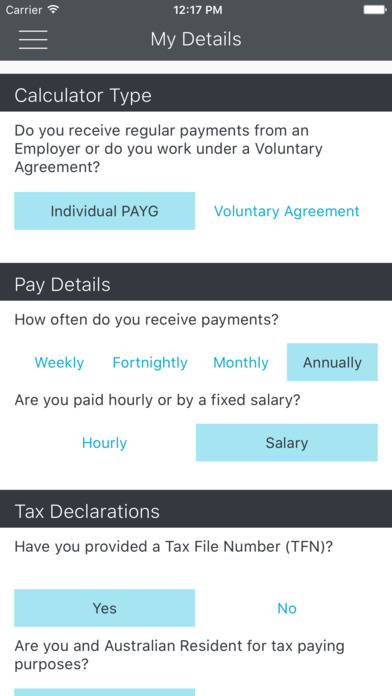

- PAYG calculations (Voluntary Agreement calculations to be removed in next update)

- Select between Hours by Rate or Salary

- Select the frequency you are paid from Weekly, Fortnightly, Monthly or Annually

- Enter Deductions

- Standard superannuation calculations including customisable entry

- Medicare levy and surcharge based on private health insurance arrangement.

- Low income tax credit

- Family considerations (spouse and dependents)

- HELP/HECS and SFSS

- Select how you want to see the breakdown (Weekly, Fortnightly, Monthly or Annually)

- Advanced details for making the PAYG calculation as accurate as possible

Disclaimer:

While we ensure all calculations are extremely accurate and in line with ATO tables and brackets. Your specific situation may vary based on details this general app isnt able to capture. Please use these calculations as an indicator.